Featured Insights

Solar PV Market and Investment Opportunities in Turkey

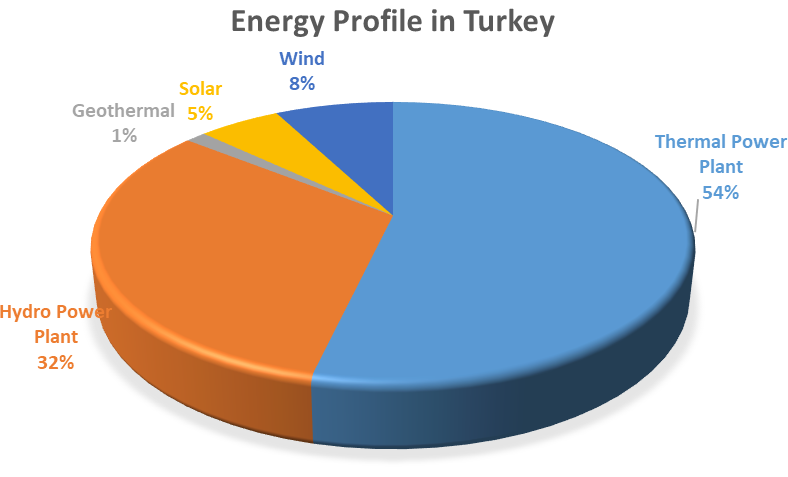

Turkey has a substantial amount of renewable energy potential, and the utilization of this potential has been increasing over the last decade. By the end of July 2018, hydro and wind resources constitute the vast majority of the Turkey’s renewable energy resources, accounting for 27,456 MW and 6,580 MW respectively of the total installed capacity of more than 87,040 MW. However, Solar PV energy will also comprise a significant portion of the total capacity as rapid growth in utilization of Solar PV energy resources will be experienced in coming years.

In accordance with the European Parliament and Council Directive 2009/28/EC on 23 April 2009, on the promotion of the use of the use of energy from Renewable Resources, Turkey’s primary goal was defined as to increase the share of domestic and renewable energy resources in the total installed power capacity.

In this new period, three investment models are in place in the Turkish renewable energy market: Unlicensed, Licensed and YEKA model.

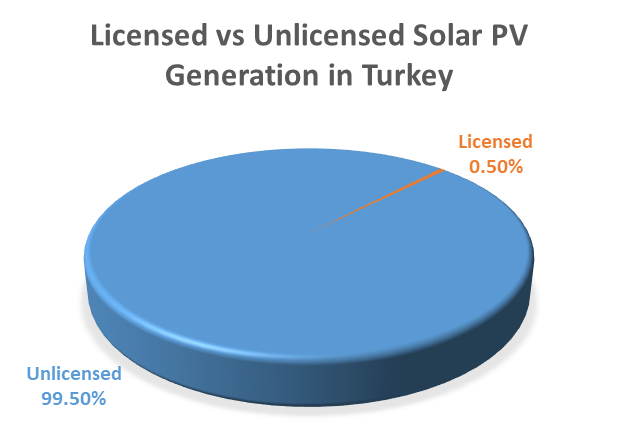

According to the regulation on Unlicensed Power Generation, real and legal persons may license-free generate electricity from a Solar PV power plant, provided that the installed capacity will not exceed 1 MW. Some types of Unlicensed Solar PV systems may exceed the 1 MW limit, if they are to use the energy that they generated to meet their own electricity. Beyond that, until the amendments that were made to the unlicensed generation regulation on 23 March 2016, it was not clear, whether any given unlicensed Solar PV power plants are allowed to be developed within the same region, by multiple power plants each having an installed capacity up to 1 MW. This has been criticized as a reason for circumventing the rules concerning licensing requirements. Therefore, due to the, its size (up to 1 MW) limit, latest regulatory changes and extreme fee charges (distribution fee), investing for Unlicensed Solar PV power plants is not a good option for the large-scale investors.

Licensed Solar PV power plants deals with the types of investment models over 1 MW installed capacity. For licensed Solar PV investments, the investors apply to EMRA for pre-license in the first stage. The current regulation on licensing requires the applicants must have metering data of at least 1-year period, but only half of the data must be collected on site for Solar PV systems. Ministry of Energy and Natural Resources announced the grid connection capacities in total 600 MW for Solar PV energy based licensed production facilities in 2011 and starting from 2014, Solar PV power generation licenses are being granted to applicants until the mid of 2015 for 600 MW by auctions in 27 different regions in Turkey. Additional connection capacities are to be announced every year on 1st of April, starting from 2014. However, for licensed Solar PV no announcements were made since then.

The rate of Licensed Solar PV power plants installation is so slow compared to the Unlicensed model due to the allocated capacity, which was 600 MW and high contribution margins offered during the tender processes. Until now, 3 of the licensed Solar PV power plants with 22.9 MW connection capacity, have been successfully commissioned and started commercial operations. The remaining licensed Solar PV power plants either in pre-license, license or construction period.

In contrast with the earlier Electricity Market License Legislation, share transfer of the Licensed Solar PV plant is stretched out with the newest version of Electricity Market License Legislation published in 2017. In the previous version, change in the shareholding structure before provisional acceptance was prohibited. In recent months, the cost of the main Solar PV components (PV Module and Inverter) show a falling tendency. In parallel, the depreciation in Turkish Lira against European Euro and American Dollar in the recent months, also having a positive financial impact on contribution margins offered in Turkish Lira during tender process to grant licenses. Therefore, the Licensed Solar PV power plants, which are under pre-license, license and construction stages can be a suitable investment model for the investors.

The last investment model investigated in this report is YEKA, which is the new renewable support scheme of Turkey and its legal structure designed in the Regulation on Renewable Energy Resources Areas (YEKA regulation), which came into force in 2016. YEKA model is mainly the composition of two main facts for supporting Renewable Energy investments. The first is establishing large scale renewable energy resources, and the second is enabling using high-tech equipment, which are domestically manufactured or supplied. In accordance with the regulation, YEKAs are to be developed by two means: As a result of operations conducted by the General Directorate of Renewable Energy (YEGM); or as a result of the tender of connection capacity allocation for YEKAs and the operations to be conducted afterwards.

The potential sites for new solar YEKA projects for which tenders are planned to be held in 2018, were recently announced by the General Directorate of Renewable Energy (YEGM). Details of the new tenders, such as allocation mechanism (new factory or procurement form local manufacturers), localization rate, and ceiling price are also planned to be released in the following months accordingly. The fifteen-year duration of YEKA and some other positive facts of Turkey’s developing country status including its grooving demand for electricity in the USD exchange base price makes YEKA attractive for the investors.

In summary, Turkey with its unique location, growing population and developing economy is a promising country for successful development of solar investments. The regulatory frame work that provides incentives for both licensed and YEKA Solar Power PV power generation investments has gradually developed since the publication of the Renewable Energy Law. By the opportunity of the new tenders, which are announced by General Directorate of Renewable Energy, YEKA Solar PV investment models will gain momentum in the near future. Considering the targets designated by the government for Solar PV, the Turkish solar PV market, is definitely a niche sector for international investors.